Have You Ever?

Have you ever thought to yourself, “Where does money come from?”, “Who produces it?”, and most importantly, “Who the heck controls it?” These are questions that most of us ask ourselves daily as we’re surrounded by goods and services that require us to either give or take money.

Here’s Why

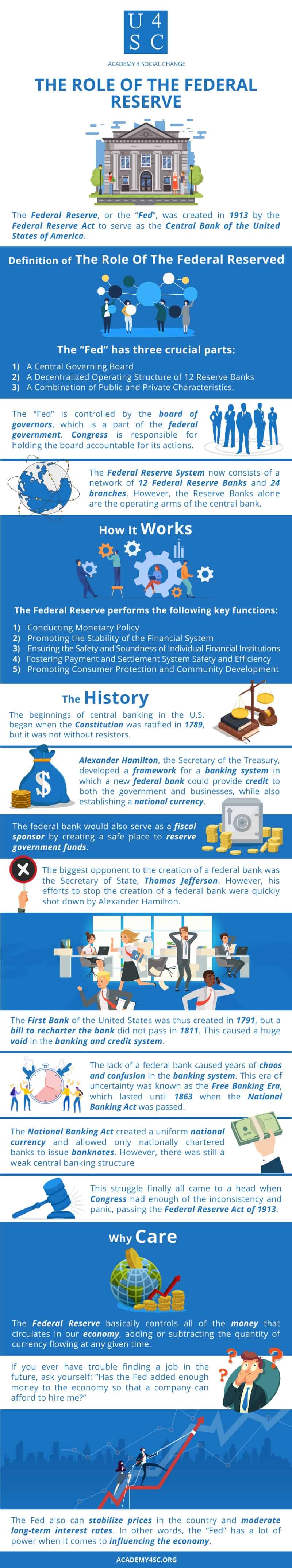

The answer to all three of your questions is the Federal Reserve. The Federal Reserve, or the “Fed” as it is commonly referred to, was created in 1913 by the Federal Reserve Act to serve as the Central Bank of the United States of America.

The Role of the Federal Reserve

The architects of the Federal Reserve Act were against the concept of a single central bank; thus, the “Fed” has three crucial parts which keep this notion true: 1.) A Central Governing Board, 2.) A Decentralized Operating Structure of 12 Reserve Banks, and 3.) A Combination of Public and Private Characteristics.

In addition, although not technically “owned” by any particular person or institution, the “Fed” is controlled by the board of governors, which is a part of the federal government. Congress is responsible for holding the board accountable for its actions. The Federal Reserve System now consists of a network of 12 Federal Reserve Banks and 24 branches. However, the Reserve Banks alone are the operating arms of the central bank.

How It Works

The Federal Reserve performs five key functions to ensure the effective operation of the United States economy. They are:

- Conducting Monetary Policy (adding or subtracting the amount of money in the economy)

- Promoting the Stability of the Financial System

- Ensuring the Safety and Soundness of Individual Financial Institutions (keeping financial institutions honest)

- Fostering Payment and Settlement System Safety and Efficiency

- Promoting Consumer Protection and Community Development (Making sure the common American citizen has protections against fraud and predatory institutions)

The History

Before the creation of the Federal Reserve, the U.S. was overrun by frequent occurrences of panic, failures of local banks, and the lack of available credit. The beginnings of central banking in the U.S. began when the Constitution was ratified in 1789, but it was not without resistors. Alexander Hamilton, the Secretary of the Treasury during the time, developed a framework for a banking system in which a new federal bank could provide credit to both the government and businesses, while also establishing a national currency. The federal bank would also serve as a fiscal sponsor by creating a safe place to reserve government funds.

The biggest opponent to the creation of a federal bank was the Secretary of State, Thomas Jefferson. Jefferson was an advocate for the states having more power than the federal government, asserting that the Constitution did not outright authorize the federal government to create a central bank or issue paper currency. However, his efforts to stop the creation of a federal bank were quickly shot down by Alexander Hamilton, who was supported by the ruling Federalist Party. The First Bank of the United States was thus created in 1791, but a bill to recharter the bank did not pass in 1811. This caused a huge void in the banking and credit system. States looked to fill this void with their own paper money and credit systems, which were controversial at best.

The lack of a federal bank caused years of chaos and confusion in the banking system, almost creating a free-for-all of sorts between the various state banks. This era of uncertainty was known as the Free Banking Era, which lasted until 1863 when the National Banking Act was passed. The National Banking Act created a uniform national currency and allowed only nationally chartered banks to issue banknotes. However, there was still a weak central banking structure. This struggle finally all came to a head when Congress had enough of the inconsistency and panic, passing the Federal Reserve Act of 1913.

Why Care?

Why is this important you ask? Well, the Federal Reserve basically controls all of the money that circulates in our economy, adding or subtracting the quantity of currency flowing at any given time. If you ever have trouble finding a job in the future, ask yourself: ”Has the Fed added enough money to the economy so that a company can afford to hire me?”

The Fed also can stabilize prices in the country and moderate long-term interest rates. In other words, the “Fed” has a lot of power when it comes to influencing the economy.