Have You Ever?

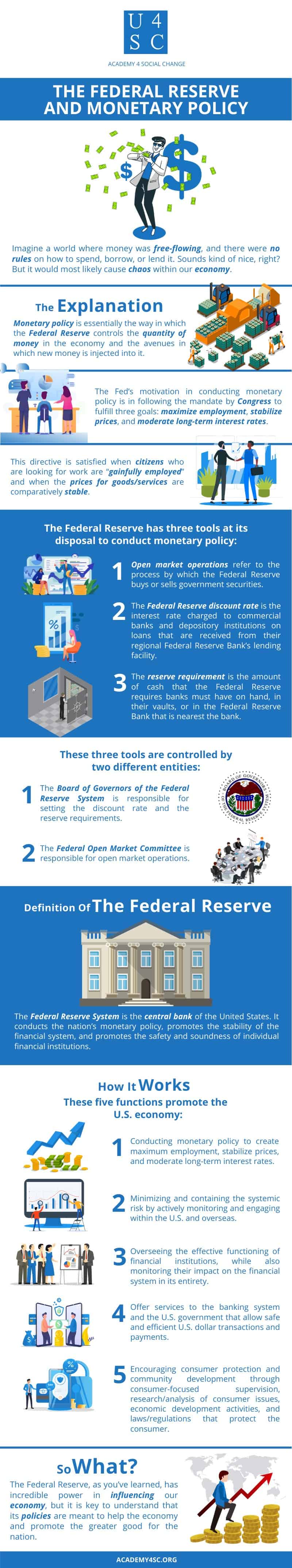

Imagine a world where money was free-flowing, and there were no rules on how to spend, borrow, or lend it. Sounds kind of nice, right? Well, hold on to your seat for a few minutes as we’ll explain how although that may sound like a good idea in theory, in practice, it would most likely cause chaos within our economy.

The Explanation

Monetary policy is essentially the way in which the Federal Reserve controls the quantity of money in the economy and the avenues in which new money is injected into it. The Fed’s motivation in conducting monetary policy is in following the mandate by Congress to fulfill three goals: maximize employment, stabilize prices, and moderate long-term interest rates. This directive is satisfied when citizens who are looking for work are “gainfully employed” and when the prices for goods/services are comparatively stable.

The Federal Reserve has three tools at its disposal to conduct monetary policy: open market operations, the discount rate, and reserve requirements. These three tools are actually controlled by two different entities. The Board of Governors of the Federal Reserve system is responsible for setting the discount rate and the reserve requirements. The Federal Open Market Committee is responsible for open market operations.

In order to better understand the tools that the Federal Reserve uses, we’ll define them here so that you can develop a deeper understanding as we go along:

- Open market operations refer to the process by which the Federal Reserve buys or sells government securities. This process is considered “open” because the Fed cannot pick and choose what securities dealers it wants to work with; instead, the securities dealers compete against each other on the price of the government securities market.

- The Federal Reserve discount rate is the interest rate charged to commercial banks and depository institutions on loans that are received from their regional Federal Reserve Bank’s lending facility. The Fed is able to offer three different types of credit to depository institutions: primary, secondary, and seasonal credit. All three of these credits have different associated interest rates and are all fully secured. These rates are uniform across all of the Federal Reserve’s banks and are determined by the Reserve Bank’s Board of Directors.

- The reserve requirement is the amount of cash that the Federal Reserve requires banks must have on hand, in their vaults, or in the Federal Reserve Bank that is nearest the bank.

- Effective monetary policy is based strictly on the situation presented. One such example would be a situation in which a country is facing high unemployment and a recession at the same time. It’s the job of the Federal Reserve to set the correct monetary policies in order to jumpstart the economy and lower the unemployment rate. In this case, the best solution would be to start an expansionary monetary policy. This policy would allow the Fed to lower interest rates, leading to an increased supply of cash, higher spending rates, and increased employment rates as businesses choose to grow instead of contract their labor force.

The Federal Reserve

The Federal Reserve System is the central bank of the United States. The Federal Reserve conducts the nation’s monetary policy, promotes the stability of the financial system, and promotes the safety and soundness of individual financial institutions.

How It Works

The Federal Reserve System has five general functions to promote the optimal function of the U.S. economy (According to the Federal Reserve):

- Conducting monetary policy to create maximum employment, stabilize prices, and moderate long-term interest rates.

- Minimizing and containing the systemic risk by actively monitoring and engaging within the U.S. and overseas.

- Overseeing the effective functioning of financial institutions, while also monitoring their impact on the financial system in its entirety.

- Offer services to the banking system and the U.S. government that allow safe and efficient U.S. dollar transactions and payments.

- Encouraging consumer protection and community development through consumer-focused supervision, research/analysis of consumer issues, economic development activities, and laws/regulations that protect the consumer.

So What?

The Federal Reserve, as you’ve learned, has incredible power in influencing our economy, but it is key to understand that its policies are meant to help the economy and promote the greater good for the nation. In theory, it should always remain uninfluenced by any political leanings, striving just for generally helping the public interest.