Have You Ever?

You’ve heard it before on the news: “The Federal Reserve lowers interest rates to 0.50 percent” or “The Federal Reserve raises interest rates to 3.0 percent”. All that sounds pretty simple, but what exactly does it mean and do?

Here’s Why

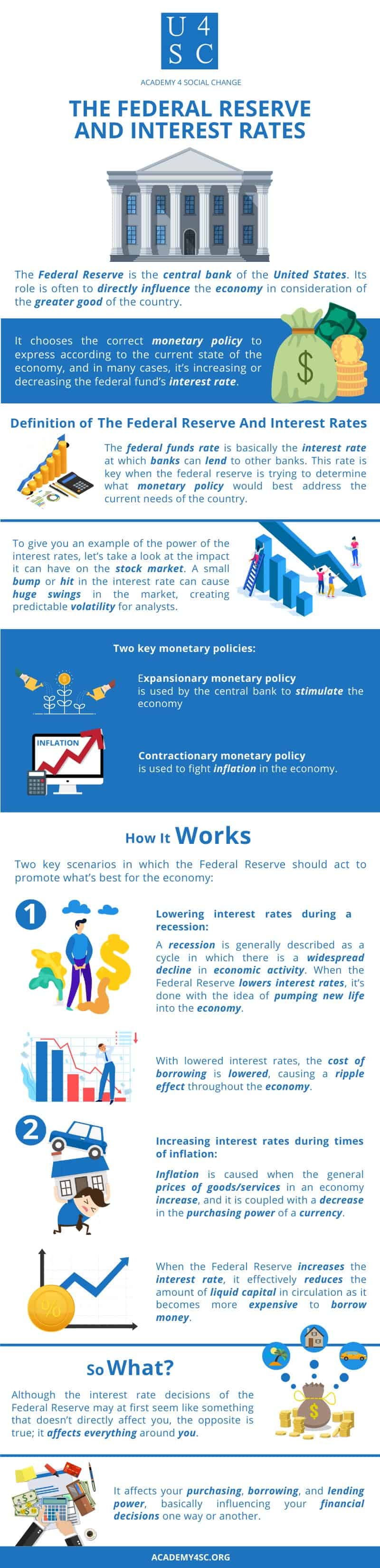

The Federal Reserve is the central bank of the United States. Its role is often to directly influence the economy in consideration of the greater good of the country. It chooses the correct monetary policy to express according to the current state of the economy, and in many cases, it’s increasing or decreasing the federal fund’s interest rate.

The Federal Reserve and Interest Rates

The federal funds rate is the interest rate target determined by the Federal Reserve at which depository institutions can lend reserves to other depositories; basically, it’s the interest rate at which banks can lend to other banks. This rate is key when the federal reserve is trying to determine what monetary policy it should adopt to best address the current needs of the country.

To give you an example of the power that interest rates can have on the economy, let’s take a look at the impact it can have on the stock market. One of the key updates that stock market analysts look for when predicting the moves of the market are the reports/news that come from the Federal Reserve. A small bump or hit in the interest rate can cause huge swings in the market, creating predictable volatility for analysts.

Two key monetary policies are important for you to understand:

Expansionary monetary policy and contractionary monetary policy.

Expansionary monetary policy is used by the central bank to stimulate the economy, while contractionary monetary policy is used to fight inflation in the economy.

How It Works

There are two key scenarios in which the Federal Reserve should act to promote what’s best for the economy:

- Lowering interest rates during a recession:

A recession is generally described as a cycle in which there is a widespread decline in economic activity (decreased spending, increased saving). When the Federal Reserve lowers interest rates, it’s done with the idea of pumping new life into the economy. With lowered interest rates, the cost of borrowing is lowered, causing a ripple effect throughout the economy. People now start borrowing money at increased levels, spending increases, and companies are more likely to increase their hiring/investing. All of these effects combined with other effects are a catalyst for the economy, helping it move out of a recession.

- Increasing interest rates during times of inflation:

Inflation is caused when the general prices of goods/services in an economy increase, and it is coupled with a decrease in the purchasing power of a currency. When the Federal Reserve increases the interest rate, it effectively reduces the amount of liquid capital in circulation as it becomes more expensive to borrow money. This in turn causes the economy to slow, decreasing demand, and decreasing prices.

So What?

Although the interest rate decisions of the Federal Reserve may at first seem like something that doesn’t directly affect you, the opposite is true; it affects everything around you. It affects your purchasing, borrowing, and lending power, basically influencing your financial decisions one way or another. The next time you go to the mall and buy a new shirt, think to yourself, ”Did the Federal Reserve make this new shirt more expensive or cheaper for me to buy?”