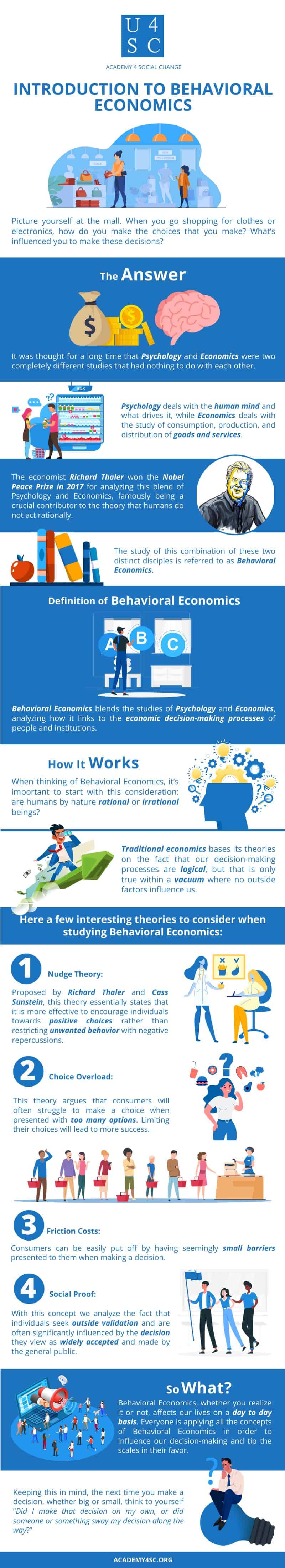

Have You Ever?

Picture yourself at the mall. When you go shopping for clothes or electronics, how do you make the choices that you make? What’s influenced you to make these decisions? Was there a conscious or unconscious motivator to your decision? Why did you buy that exact pair of jeans or shirt?

For an even deeper thought...let’s say you see a pair of shoes that you really like, there are two choices for you to make but here are the factors to consider: 1. The shoes look exactly the same, 2. One is a brand name you like, the other is a store brand, 3. The brand name shoe is 30% more expensive. Which pair of shoes do you buy and why?

The Answer

It was thought for a long time that Psychology and Economics were two completely different studies that had nothing to do with each other. Psychology deals with the human mind and what drives it, while Economics deals with the study of consumption, production, and distribution of goods and services. So what exactly does one have to do with the other?

The economist Richard Thaler focused his career on answering this question. He won the Nobel Peace Prize in 2017 for analyzing this blend of Psychology and Economics, famously being a crucial contributor to the theory that humans do not act rationally. The study of this combination of these two distinct disciples is referred to as Behavioral Economics.

Behavioral Economics

Behavioral Economics blends the studies of Psychology and Economics, analyzing how it links to the economic decision-making processes of people and institutions.

How It Works

When thinking of Behavioral Economics, it’s important to start with this consideration: are humans by nature rational or irrational beings? As you’ll learn, although it may seem like decisions that we make on a daily basis are rational, in reality, humans make a lot of irrational choices which often clash with some of the central theories of economics.

Traditional economics bases its theories on the fact that our decision-making processes are logical, but that is only true within a vacuum where no outside factors influence us. Take as an example the decision the UK made in 2016 voting to leave the European Union in the famous vote on “Brexit” as it was known. The Nobel Peace Prize winner, Richard Thaler, argued that this vote to leave the European Union was influenced by gut feeling rather than logical thought, as many scholars argued that there would be wide-spread negative ramifications to “Brexit” than actual benefits.

Here a few interesting theories to consider when studying Behavioral Economics:

- Nudge Theory: proposed by Richard Thaler and Cass Sunstein, this theory essentially states that it is more effective to encourage individuals towards positive choices rather than restricting unwanted behavior with negative repercussions. Ex: In order to promote healthy eating habits in schools, the cafeteria should place fruits/vegetables at eye level for students, and place junk foods in harder to reach places. Thus increasing the odds that they make healthy choices.

- Choice Overload: have you ever found yourself in front of the beverage section looking for a soda wondering to yourself, “What do I want to drink?” It sounds simple, but in reality, the difficulty might be more due to choice overload than your indecisiveness. This theory argues that consumers will often struggle to make a choice when forced to make a decision when presented with too many options. Limiting their choices will lead to more success.

- Friction Costs: consumers can be easily put off by having seemingly small barriers presented to them when making a decision. A prime example would be a long line at the supermarket when all you have to purchase is a few things. Consumers will often decide against waiting on the line and just purchase at a later date. This issue was noticed by supermarkets and they sought to solve the issue with “express lanes” which only allowed consumers with 1-10 items.

- Social Proof: with this concept we analyze the fact that individuals seek outside validation and are often significantly influenced by the decision they view as widely accepted and made by the general public. Think of this example when considering this theory: are you more likely to recycle if a sign reads “Please help keep the world clean and recycle.” or “Most New Yorkers want to keep the world clean, join your fellow New Yorkers in helping to keep the world clean and recycle.”

So What?

Behavioral Economics, whether you realize it or not, affects our lives on a day to day basis. From large corporations to federal governments, they are all applying the concepts of Behavioral Economics in order to influence our decision-making and tip the scales in their favor so that we make the decisions they would like us to make. Keeping this in mind, the next time you make a decision, whether big or small, think to yourself “Did I make that decision on my own, or did someone or something sway my decision along the way?”